Based on the provisions of the Tax Cuts and Jobs Act of 2017, the Internal Revenue Service (IRS) has once again updated the Cost-of-Living Adjustments for 2018. In recently issued guidance, the IRS has adjusted the limits on health savings accounts (HSAs).

For calendar year 2018, while the annual limitation for an individual with self-only coverage has not changed, the annual limitation for an individual with family coverage under a high-deductible health plan has decreased by $50 from $6,900 to $6,850. This decrease in the family coverage limit for contributions to HSAs may require an adjustment in your payroll system to avoid employees’ HSA contributions exceeding the newly adjusted limit.

As additional information, in this guidance, the IRS also reduced the credit allowed for Adoption Assistance related expenses from $13,840 to $13,810.

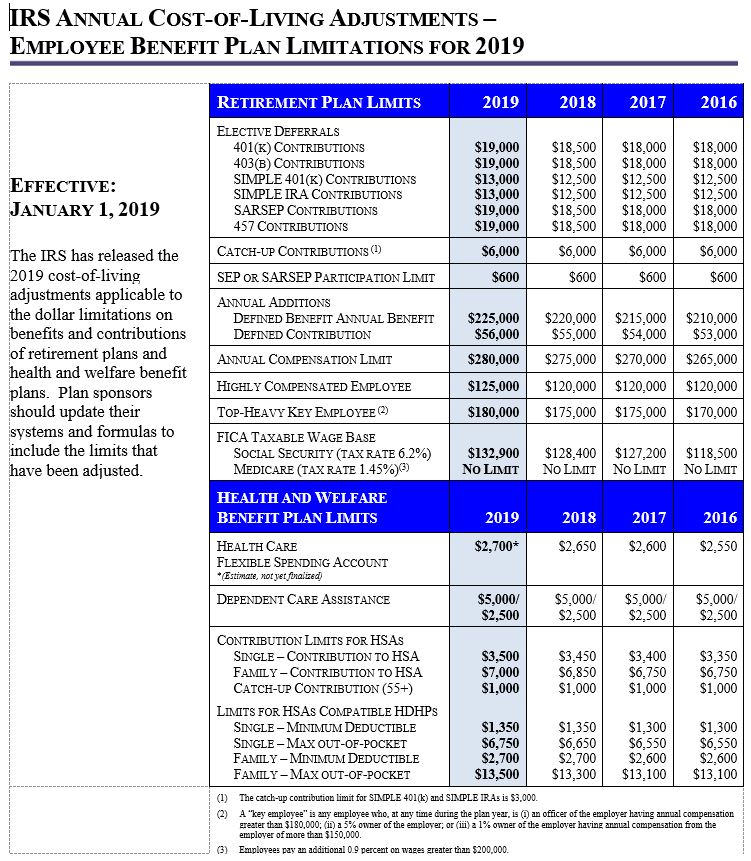

For a printable version of this chart, click here.

This client alert is intended to inform clients and other interested parties about legal matters of current interest and is not intended as legal advice. If you have any questions regarding these issues, please contact your Executive Compensation and Employee Benefits Counsel at Smith, Gambrell & Russell, LLP.